Australian investor fondness for “fortress balance sheet” tier-two on show again

ANZ Banking Group printed what it believes is the world’s first “national champion bank” tier-two benchmark deal after the Silicon Valley Bank crisis on 8 May. It attracted a predominantly domestic real-money book in another demonstration of this investor base’s preference for tier-two as its higher-yielding credit asset of choice.

The deal was for A$1.15 billion (US$780.2 million) at 10-year non-call five (10NC5) tenor. The deal book peaked at A$2 billion, according to the issuer, and offered a margin of 235 basis points over swap benchmarks. It is the first Australian big-four bank domestic tier-two benchmark since a Commonwealth Bank of Australia (CBA) deal in March (see table).

AUSTRALIAN BIG-FOUR BANK DOMESTIC TIER-TWO BENCHMARKS, H1 2022-23

| Pricing date | Issuer | Total volume (A$m) | Tenor (years) | Margin (bp/swap) |

|---|---|---|---|---|

| 6 Apr 22 | Commonwealth Bank of Australia | 1,100 | 10NC5 | 190 |

| 3 Aug 23 | ANZ Banking Group | 1,750 | 10NC5 | 270 |

| 26 Jul 22 | National Australia Bank | 1,250 | 10NC5 | 280 |

| 13 Sep 22 | ANZ Banking Group | 900 | 13NC7 | 260 |

| 27 Oct 22 | Commonwealth Bank of Australia | 2,000 | 10NC5 | 270 |

| 6 Feb 23 | ANZ Banking Group | 1,000 | 15NC10 | 280 |

| 1 Mar 23 | National Australia Bank | 1,250 | 10NC5 | 217 |

| 6 Mar 23 | Commonwealth Bank of Australia | 1,750 | 15NC10 | 245 |

| 8 May 23 | ANZ Banking Group | 1,150 | 10NC5 | 235 |

Source: KangaNews 9 May 2023

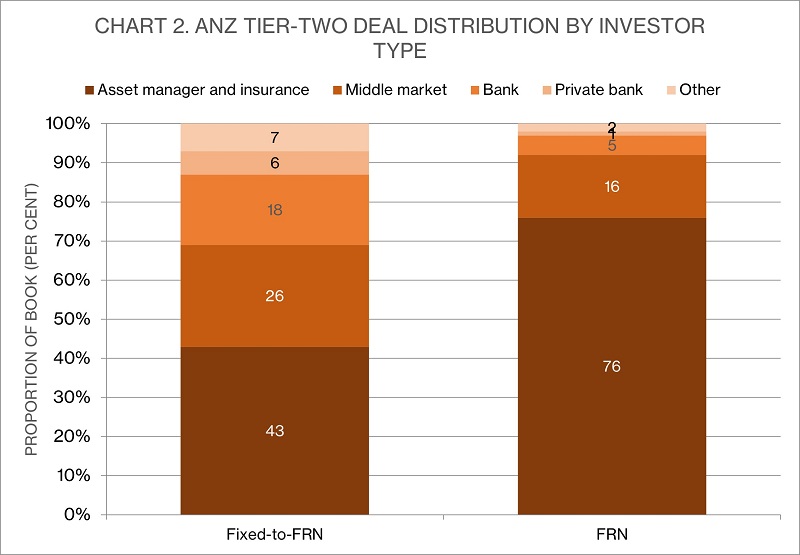

The transaction is one of two substantial prints immediately following results announcements by ANZ, National Australia Bank and Westpac Banking Corporation. NAB priced a record A$5.25 billion senior-unsecured deal on 4 May. Scott Gifford, the ANZ’s Melbourne-based head of group funding, highlights the support of domestic real-money investors (see charts 1 and 2) following reporting season.

“Domestic investor support for major-bank tier-two issuance is very much a vote of confidence in the Australian banking system,” he suggests. “The recent round of half-year results across ANZ, NAB and Westpac demonstrates once more that the system is very strong, with fortress balance sheets across the sector.”

The Australian dollar market has been quicker than most to reopen for bank subordinated debt than many others. Gifford tells KangaNews: “This deal is the first benchmark bank tier-two transaction from a ‘national champion’ bank globally since the collapse of Silicon Valley Bank. It is easy to forget that conditions remain tough across many markets, which only highlights the status of Australian banks as a safe haven for fixed-income investors. In a world of uncertainty they represent a flight to quality.”

Domestic investors appear more willing to support bank tier-two deals than equivalent-rated true corporate supply. ANZ’s deal took Australian bank tier-two issuance volume to A$6 billion so far this year, compared with A$2.1 billion of corporate deal flow. The biggest challenge for corporates may be that many want to issue with more duration.

Source: ANZ 9 May 2023

Source: ANZ 9 May 2023

“The tenor we issue at helps,” Gifford suggests. “Bank supply is primarily in the 3-5 year range, and the reality is that there is still some uncertainty about the path of rates. In this sort of environment, shorter tenor suits investors. Having greater line of sight on rates trajectory should help support demand for the 5-10 year part of the curve.”

“This deal is the first benchmark bank tier-two transaction from a ‘national champion’ bank globally since the collapse of Silicon Valley Bank. It is easy to forget that conditions remain tough across many markets, which only highlights the status of Australian banks as a safe haven for fixed-income investors.”

ANZ itself was not tempted to test the market for tier-two issuance beyond 10NC5. Gifford continues: “Our strategy with tier-two has been investor led, with their preference being for us to issue one large liquid 10NC5 benchmark annually. Around this benchmark we are happy to explore other Australian dollar issuance in response to demand. Our last 10NC5 was in August last year and we have also been able to print at 12NC7 and 15NC10 tenor since then – so this deal was always going to be our annual Australian dollar 10NC5.”

The bank has a relatively small issuance need overall for the balance of its financial year. It reported a tier-two requirement of around A$2 billion for the next six months, the majority of which is accounted for by the new deal. This transaction also contributes to a A$5-10 billion total wholesale funding requirement for the second half, ANZ having issued A$26 billion in the preceding six months including bringing forward its most recent domestic benchmark and a euro covered bond. Gifford confirms that its near-term issuance pipeline is therefore relatively limited.