Offshore accounts buy into NOW Finance story

Offshore investor support enabled NOW Finance to issue an asset-backed securities transaction that was more than twice the size of its previous deal, the issuer says. Risk-retention compliance was key in securing the offshore bid, and issuer and lead are confident that, with this work complete, appetite will be robust for future deals.

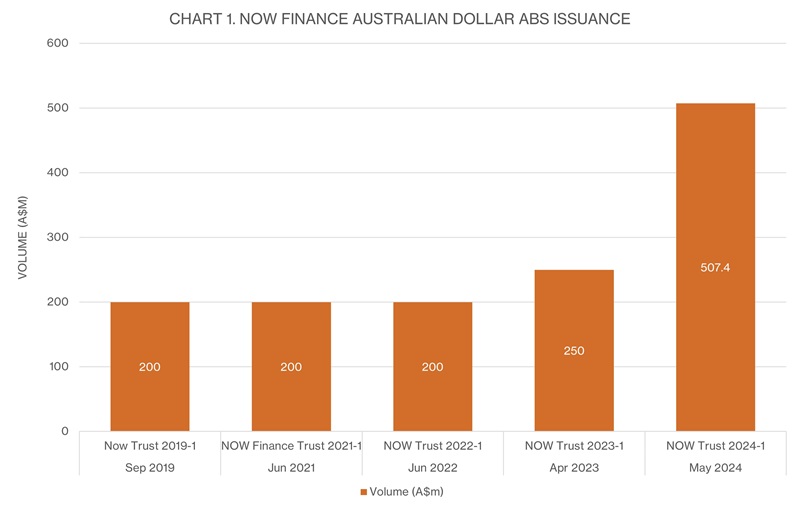

Made up of half each of personal loans and auto collateral, the upsized A$507.4 million (US$335.1 million) deal is indicative of NOW Finance’s growth journey, notes James Cunningham, the borrower’s Melbourne-based treasurer.

While the nonbank got its start in its secured and unsecured personal loans, it added vehicle loans to its product suite in 2022. This resulted in a transaction more than double the size of its previous term securitisation deal (see chart 1).

“We are in the next stage of growth,” Cunningham tells KangaNews. “The new auto product has had very good traction with our broker network, and our originations have gone from a standing start to quite a material amount. This has put us in a position to securitise a larger pool.”

Most of the deal was concentrated in the triple-A notes, which totalled A$412.4 million – of which 33 per cent was allocated to offshore accounts. Across the structure, offshore accounts took 30 per cent of the transaction (see chart 2)

Source: KangaNews 30 May 2024

Cunningham says the offshore piece was a target for the transaction. Without this support, Cunningham believes the transaction would have capped at A$300 million. “The domestic investor universe, across mezzanine and senior, has been incredibly supportive of our programme but the domestic market can only take us so far, and to reach the next step we needed to add new investors,” he explains.

"The new auto product has had very good traction with our broker network, and our originations have gone from a standing start to quite a material amount. This has put us in a position to securitise a larger pool.”

Button TextThe addition of European risk-retention compliance and European Securities and Markets Authority reporting was a key component of securing the offshore bid, Cunningham continues. “Features like these are a hard requirement for some larger pools of offshore capital,” he adds.

Such features are common among Australian securitisers that seek access to offshore capital pools. However, they are usually only added once an issuer is of significant scale to require consistent access to a larger investment base, notes Rebecca Fodera, director, securitisation origination at National Australia Bank in Sydney.

She says that combined with the upsize, these features helped NOW Finance to meet the minimum requirements a lot of investors needed and put the borrower in good stead for future business growth. “The risk-retention compliance and upsize allowed offshore investors to participate, and as a result there was very strong support from real money,” she comments. “The business is growing – particularly since the addition of auto loans – and now they have access to more offshore investors as they look to issue more frequently and at larger size.”

Cunningham expects many of the new offshore accounts will be long-term, rather than opportunistic, supporters of the programme. “There were several offshore accounts who spent a great deal of time assessing our underwriting, servicing and receivable performance. It feels like a relationship that is not going to be transactional: they have taken the time to gain a deeper understanding and it feels as if they will become long-term partners of the business as a programmatic issuer,” he says.

There were 16 investors in total, with 14 of these being in the triple-A notes. Real money made up more than 80 per cent of the allocation, while the remainder was bank balance sheet and joint-lead manager aligned (see chart 3).

Source: National Australia Bank 31 May 2024

Source: National Australia Bank 31 May 2024

The senior notes printed at 140 basis points over one-month bank bills. This was equal to the initial price guidance NOW Finance provided when it started marketing the trade the week prior to pricing.

Cunningham says there might have been an opportunity to tighten pricing. However, it likely would have come at the sacrifice of its objective to broaden the investor base. “Rather than to achieve the tightest price we could, it was important to print the right price that also brought investors along,” he says.