KangaNews Fixed Income Trading and Research Poll 2024: tectonic shift

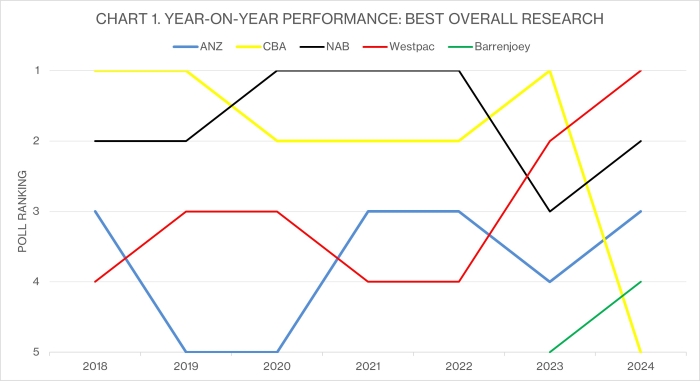

The 2024 iteration of the KangaNews Fixed Income Trading and Research Poll marks a significant change in the landscape of market support. A new bank has risen to the top of the research landscape, while the results overall show much more volatility in outcome than has typically been the case.

A year ago, KangaNews added categories covering secondary market support to the long-running KangaNews Fixed Income Research Poll. Westpac Institutional Bank scored a knockout victory across these categories, completing a near clean sweep as a trading house. In 2024, Westpac not only repeats its recognition as a trading house but supplements its secondary market accolades with a clutch of successes in the research categories.

Westpac wins three of the six sector research categories – adding macroeconomics to the credit and securitisation wins it notched in 2023 – while leapfrogging Commonwealth Bank of Australia (CBA) into top spot in the overall category (see chart 1).

Westpac’s win in the macro category marks the fourth year running that this category has had a new winner: Westpac replaced National Australia Bank (NAB) at the top of the tree in 2021, NAB snatched top spot back in 2022 and CBA took over last year (see chart 2). The credit category has been more consistent, as this is the fourth year running in which Westpac has taken top spot (see chart 3).

Over the years, consistency has been the main theme of the KangaNews poll – but the 2024 results represent a significant shake-up. Nowhere is this more clear than the rates research category, ANZ leaps up from fourth to claim a category win while CBA surrenders a top placing it had recorded in every year since the category was introduced in 2018 (see chart 4).

The overall research landscape continues to be dominated by domestic houses, though Deutsche Bank recaptures the international market category that NAB won in 2023. Indeed, the domestic stranglehold is if anything further tightened by the increased prominence of Barrenjoey, which records its first-ever podium finishes – in macro and rates research.

The trading categories, by contrast, largely produce the same results as last year. The top five credit trading houses finish in the same order, with Westpac top of the charts, while there is only minimal shuffling of the order of domestic sovereign and semi-government trading firms (see chart 5) – Westpac again finishing on top albeit with ANZ close on its heels this year. Westpac also retains its lead as a securitisation trader.

The category covering supranational, sovereign and agency bonds is also retained, by ANZ, in a very close three-way battle in which Westpac jumps into second place over last year’s runner-up, RBC Capital Markets.

Poll methodology

The KangaNews Fixed Income Trading and Research Poll is a unique opportunity for the Australian domestic fixed income investor community to acknowledge the analysts and brokers that support the functionality of the Australian debt market outside primary issuance.

Conducted online, the survey only records the votes of Australia-based institutional investors. All votes go through a rigorous verification process to ensure only the opinions of qualifying institutional investors are included in the final tally.

This year, there were once again well over 100 qualifying votes, with the voting sample representing most key institutional investment funds in the Australian market, across the funds management, insurance and balance sheet sectors.

In 2024, voters were asked to nominate the top three providers of research across seven categories – six individual sectors and the best overall house – as well as six categories related to secondary trading support. As in previous years, positions in the best overall research category are the product of a separate vote rather than an aggregate of the other poll categories.

KANGANEWS FIXED INCOME TRADING AND RESEARCH POLL 2024: FULL RESULTS

* Denotes 2023 category winner or joint winner.

Which team provides the best overall research on Australian fixed income?

| Rank | Institution | Team |

|---|---|---|

| 1 | Westpac Institutional Bank | Martin Whetton, Damien McColough, Brendon Cooper, Martin Jacques, Uma Choudhury and Jimmy Yao |

| 2 | National Australia Bank |

Skye Masters, Ken Crompton, Michael Bush, Evy Noble, Ray Attrill, Rodrigo Catril, Gavin Friend, Alan Oster, Gareth Spence, Tapas Strickland and Taylor Nugent |

| 3 | ANZ | Adam Boyton, Jack Chambers, Richard Yetsenga, Catherine Birch, Adelaide Timbrell, Blair Chapman and Madeline Dunk |

| 4 | Barrenjoey |

Andrew Lilley |

| 5 | Commonwealth Bank of Australia* |

Adam Donaldson, Gus Medeiros, Sandeep Parekh, Andrea Jaehne, Jonathon Sterling, Stephen Halmarick, Gareth Aird and Joe Capurso |

Source: KangaNews 1 July 2024

Which team provides the best research on the Australian rates market, including government, semi-government and Australian dollar SSA bonds?

| Rank | Institution | Team |

|---|---|---|

| 1 | ANZ | Jack Chambers, Adam Boyton and Madeline Dunk |

| 2 | Westpac Institutional Bank | Damien McColough, Martin Whetton and Uma Choudhury |

| 3 | Barrenjoey | Andrew Lilley |

| 4 | National Australia Bank | Ken Crompton and Skye Masters |

| 5 | Commonwealth Bank of Australia* |

Adam Donaldson and Sandeep Parekh |

Source: KangaNews 1 July 2024

Which team provides the best research on the Australian credit market, including corporate and financial institution issuance (excluding securitisation)?

| Rank | Institution | Team |

|---|---|---|

| 1 | Westpac Institutional Bank* |

Brendon Cooper and Jimmy Yao |

| 2 | Commonwealth Bank of Australia | Gus Medeiros, Andrea Jaehne and Jonathon Sterling |

| 3 | National Australia Bank |

Michael Bush and Evy Noble |

| 4 | Deutsche Bank |

Kalvin Fernandes |

| 5 | ANZ |

Viacheslav Shilin, Ting Meng and ANZ Research |

Source: KangaNews 1 July 2024

Which team provides the best research on securitisation?

| Rank | Institution | Team |

|---|---|---|

| 1 | Westpac Institutional Bank* | Martin Jacques |

| 2 | Commonwealth Bank of Australia | Gus Medeiros and Andrea Jaehne |

| 3 | ANZ | ANZ Research |

Source: KangaNews 1 July 2024

Which team provides the best research on international markets for Australian fixed-income investors?

| Rank | Institution | Team |

|---|---|---|

| 1 | Deutsche Bank | Jim Reid, Francis Yared, Matt Raskin, George Saravelos, Alan Ruskin, Sameer Goel, Binky Chadha and Tim Baker |

| 2 | Westpac Institutional Bank |

Martin Whetton, Damien McColough, Uma Choudhury and Brendon Cooper |

| 3 | National Australia Bank* |

Ray Attrill, Tapas Strickland, Rodrigo Catril, Sally Auld, Gavin Friend, Skye Masters, Ken Crompton and Taylor Nugent |

| 4 | ANZ | Brian Martin, Tom Kenny, Richard Yetsenga, Raymond Yeung, Mahjabeen Zaman, Khoon Goh and Jennifer Kusuma |

| 5 | Commonwealth Bank of Australia | Joe Capurso, Kristina Clifton, Carol Kong, Stephen Halmarick, Adam Donaldson and Sandeep Parekh |

Source: KangaNews 1 July 2024

Which team provides the best Australian macroeconomic research?

| Rank | Institution | Team |

|---|---|---|

| 1 | Westpac Institutional Bank |

Luci Ellis, Justin Smirk, Matthew Hassan, Andrew Hanlan, Pat Bustamante, Ryan Wells, Jameson Coombs and Illiana Jain |

| 2 | ANZ | Adam Boyton, Catherine Birch, Adelaide Timbrell, Blair Chapman, Madeline Dunk and Richard Yetsenga |

| 3= | Barrenjoey | Jo Masters |

| 3= | Commonwealth Bank of Australia* | Gareth Aird, Belinda Allen, Stephen Wu, Harry Ottley and Stephen Halmarick |

| 5 | National Australia Bank | Tapas Strickland, Taylor Nugent, Alan Oster, Gareth Spence and Brody Viney |

Source: KangaNews 1 July 2024

Which team provides the best research on sustainable finance and ESG in Australian fixed income?

| Rank | Institution | Team |

|---|---|---|

| 1 | Commonwealth Bank of Australia* |

Joe Capurso, Vivek Dhar, Gus Medeiros, Jo Lyn Tan, Lauren Holtsbaum and Ali Westmore |

| 2 | ANZ | Richard Yetsenga, Catherine Birch and Daniel Hynes |

| 3 | Westpac Institutional Bank |

Michael Chen, Neville Grace, Hannah Peterson, Jeffrey Lau and Jeremy Sweeney |

| 4 | National Australia Bank |

Ken Crompton, Michael Bush and Evy Noble |

| 5= | HSBC | Wai-Shin Chan |

| 5= | UBS | Camile Wynter |

Source: KangaNews 1 July 2024

Which house provides the best secondary market support to Australian dollar sovereign and semi-government product?

| Rank | Institution |

|---|---|

| 1 | Westpac Institutional Bank* |

| 2 | ANZ |

| 3= | Commonwealth Bank of Australia |

| 3= | UBS |

| 5 | National Australia Bank |

Source: KangaNews 1 July 2024

Which house provides the best secondary market support to Australian dollar SSA product?

| Rank | Institution |

|---|---|

| 1 | ANZ* |

| 2 | Westpac Institutional Bank |

| 3 | RBC Capital Markets |

| 4 | TD Securities |

| 5 | Commonwealth Bank of Australia |

Source: KangaNews 1 July 2024

Which house provides the best secondary market support to Australian credit product (corporate and financial institution bonds, excluding securitisation)?

| Rank | Institution |

|---|---|

| 1 | Westpac Institutional Bank* |

| 2 | ANZ |

| 3 | Commonwealth Bank of Australia |

| 4 | National Australia Bank |

| 5 |

Deutsche Bank |

Source: KangaNews 1 July 2024

Which house provides the best secondary market support to Australian securitisation product?

| Rank | Institution |

|---|---|

| 1 | Westpac Institutional Bank* |

| 2 |

Deutsche Bank |

| 3 |

Commonwealth Bank of Australia |

| 4 | National Australia Bank |

| 5 | HSBC |

Source: KangaNews 1 July 2024

Does any house stand out as particularly supportive of deals it arranged/lead managed in subsequent secondary trading?

| Rank | Institution |

|---|---|

| 1 | Westpac Institutional Bank* |

| 2 | ANZ |

Source: KangaNews 1 July 2024

Does any house stand out as particularly supportive of deals it did NOT arrange/lead manage in subsequent secondary trading?

| Rank | Institution |

|---|---|

| 1 | Westpac Institutional Bank* |

| 2 | Deutsche Bank |

Source: KangaNews 1 July 2024