Domestic bid shows up for Santander’s debut tier-two Kangaroo

Lead managers on Banco Santander’s first-ever tier-two deal in the Kangaroo market highlight “insatiable” demand for the asset class, suggesting interest should be strong enough to support follow-on supply. The domestic real-money bid came through for Santander, facilitating a significant price compression and notable performance on the break.

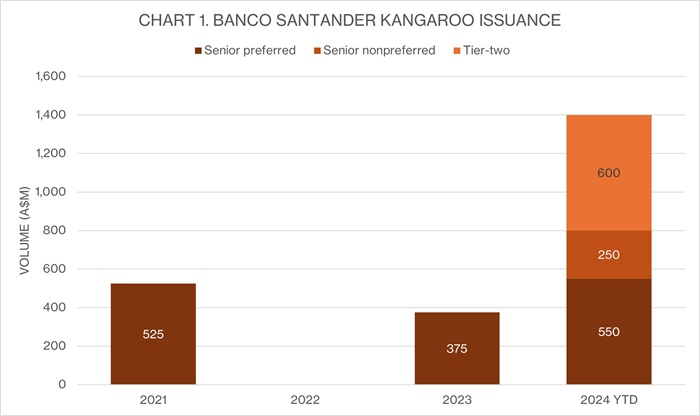

The A$600 million (US$405 million) deal is Banco Santander’s fourth Australian dollar trade since it established its Kangaroo bond programme in 2021 (see chart 1) but its first in tier-two format. The issuer says a Kangaroo deal made sense for Santander on this occasion as it offered competitive pricing, and because the issuer had a €200 million (US$217.9 million) gap to fill in its tier-two bucket where its core markets – euros and US dollars – require larger benchmark size.

The last time Santander accessed the Australian dollar market was in January this year, when it printed a A$800 million triple-tranche, senior-preferred and senior-nonpreferred deal that is its largest-ever in the Kangaroo market.

Marta Gonzalez Deprit, Santander’s senior funding manager in Madrid, tells KangaNews: “We like the dynamics of the Australian dollar market and, more specifically, the ability to diversify our investor base in Australia and across Asia. This interests us as Asia-based investors don’t always participate in our euro and US dollar deals.”

Australian dollar tier-two issuance has grown significantly in recent years and is on track for another record in 2024, but supply from international banks has been limited (see chart 2). Domestic transactions are providing useful price-discovery leads, however.

Westpac Banking Corporation’s tier-two transaction priced the week before Santander, and provided a solid platform for the Spanish bank to launch its debut Kangaroo tier-two transaction, according to Anna Germanos, Sydney-based director, debt capital markets at MUFG Securities – which led alongside ANZ and Nomura.

Demand led Santander to upsize to a capped A$600 million, from A$300-500 million at launch. It also allowed for a 25 basis point price revision during the marketing process. Gonzalez Deprit highlights the latter as “outstanding”, revealing the issuer has never tightened pricing by such a level before.

The book continued to grow despite price revisions, reaching a seven-times oversubscription at A$4.2 billion. “The demand chasing tier-two paper has been insatiable, especially for non-major bank supply,” Germanos comments. “Despite the record pace of tier-two volumes YTD, the bulk of supply has come via major bank issuance. Investors can see that these Kangaroo transactions are few and far between, and that if they miss out, it could be quite some time before another opportunity arises.”

According to Gonzalez Deprit, the level of equivalent euro tier-two deals has tightened in the past few days. But the tightened margin on the Kangaroo deal allowed Santander to maintain its targeted 10-15 basis points concession to the euro curve.

“We know we have to pay a premium of around 10-20 basis points to access smaller, regional markets and we are comfortable with that,” Gonzalez Deprit explains. “As our name becomes better known this premium might start to get smaller, though it partly depends on sentiment at the time of issue.”

There could be room for more performance in the near term, as market sources suggest Santander’s bonds tightened by approximately 20 basis points on the break. Suzy Ramos, Sydney-based executive director, debt syndicate at ANZ, adds: “Santander’s deal signals to all global borrowers that can issue tier-two that our market is open and liquid. Hopefully, it continues to encourage other offshore borrowers to consider our market.”

DOMESTIC SUPPORT

Santander’s leads also hope its deal, and the A$1.5 billion tier-two issued by HSBC Holdings in March, indicate growing support from the domestic investor base for international tier-two paper. Ramos notes: “Santander garnered its strongest Australian asset manager participation yet, by volume and number of accounts that participated. It was another stellar Australian dollar tier-two outcome, as well received as HSBC’s deal earlier this year.”

Source: KangaNews 15 July 2024

Source: KangaNews 15 July 2024

Banco Santander tier-two deal details

Issuer name: Banco Santander

Issuer rating: A+/A2/A-

Issue rating: BBB+/Baa2/BBB

Pricing date: 10 July 2024

Maturity date: 17 July 2034

Call date: 17 July 2029

Transaction type: tier-two subordinated Kangaroo notes

Total volume: A$600 million (US$405 billion)

Margin: 225bp/swap

Distribution by investor type: chart 3

Geographic distribution: chart 4

Lead managers: ANZ, MUFG Securities, Nomura

Source: MUFG Securities 11 July 2024

Source: MUFG Securities 11 July 2024

The bulk of the book comprised asset managers and insurers based in Australia and New Zealand (see charts 3 and 4).

Leads suggest the current market backdrop is aligned for tier-two supply, as demand for higher yielding products continues. Launching the Santander deal at 250 basis points over swap provided a yield target that piqued investor interest and secured domestic participation early on in the execution process.

Gonzalez Deprit believes the appeal for domestic investors is the premium Santander offers over domestic bank issuance. “More investors are willing to look at the tier-two security than senior-preferred at the moment, which makes sense considering the interest rates on offer,” she tells KangaNews.

Indeed, Gonzalez Deprit reveals that Santander needs to issue in tier-two format to meet the yield targets of Asian investors in particular. She adds: “Additional tier-one would likely also be of interest, but we tend to supply that in euros and US dollars.”

Santander’s decision to offer fixed-to-FRN and FRN tranches also helped attract a broader investor base, Germanos explains, tapping into different pools of liquidity as investor views remain divergent in an uncertain rate environment.

TIER-TWO OUTLOOK

While demand for Australian dollar tier-two product is strong, dealers suggest it remains selective. Germanos comments: “There is a significant imbalance between tier-two demand and supply in favour of issuers at the moment, especially for higher quality issuers with a strong global presence.”

Alongside its quality, leads point out Santander’s track record in the Australian dollar market – which they believe is starting to pay off. Santander generated familiarity for its name in the Australian market earlier this year, when it completed its largest-ever Kangaroo bond. The bank has also maintained a regular presence in the region by visiting investors and returning to fund every year but one since debuting its Kangaroo programme.

Gonzalez Deprit says Santander would like to print 2-3 Kangaroo deals per year. However, she says the bank will take a breather from issuance now it has completed its funding plan for the current financial year.

After the European summer break, it will begin to prefund for its 2025 financial year plan. If market conditions permit, and there is an opportunity to return to the Kangaroo market, Gonzalez Deprit says Santander will do so. This would likely be in senior-preferred or nonpreferred format.